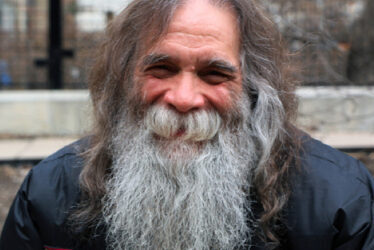

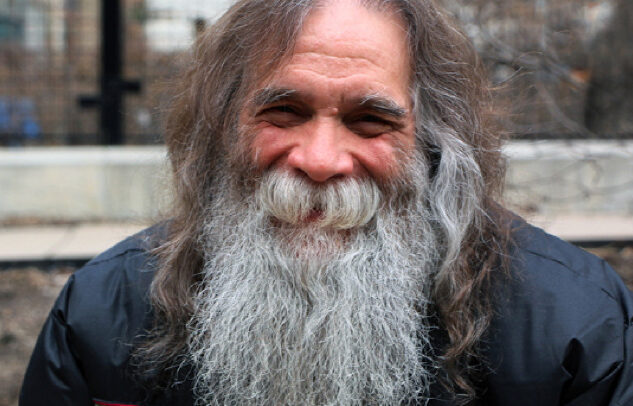

Sometimes a job is just a job. With CUCS, it isn’t. Their hearts are in it, they go the extra mile. They want to see me succeed. That means something.

Donor-Advised Funds

You can make a gift through your Donor Advised Fund. If you have created a Donor Advised Fund you have made a commitment to your philanthropy and to your desire to change the world.

Employee Giving

Many companies match employee contributions to charitable organizations, doubling or even tripling the impact of charitable gifts.

Contact your employer’s Human Resources department to see if your company will match your gift to CUCS.

Publicly Traded Stocks and Securities

Donating appreciated securities may be a smart way to minimize your taxes* and maximize your philanthropic impact.

Leave a Lasting Legacy

As you think about your legacy and the impact you want to have in perpetuity, bequests, retirement plans, or life insurance policies are a way to ensure that your gift will help rebuild lives for years to come.

Monthly Giving

Monthly donations help us have a reliable and predictable source of revenue and allows our donors to spread their philanthropic impact across an entire year.

By Mail

To make a donation by mail, please make checks payable to the Center for Urban Community Services and send to:

CUCS

Attn: Development Department

198 E 121st St

New York, NY 10035

Are you interested in learning about other ways to give to CUCS? Please click here for information on QCDs, cryptocurrency, and other tax-smart giving.

For more information on how to donate to CUCS, please contact our Development Team at celeste.finet@cucs.org

CUCS is recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code. EIN Number 13-3687891.

*This statement is for informational purposes only and should not be construed as legal, tax, or financial advice.